Reading Visual Finance

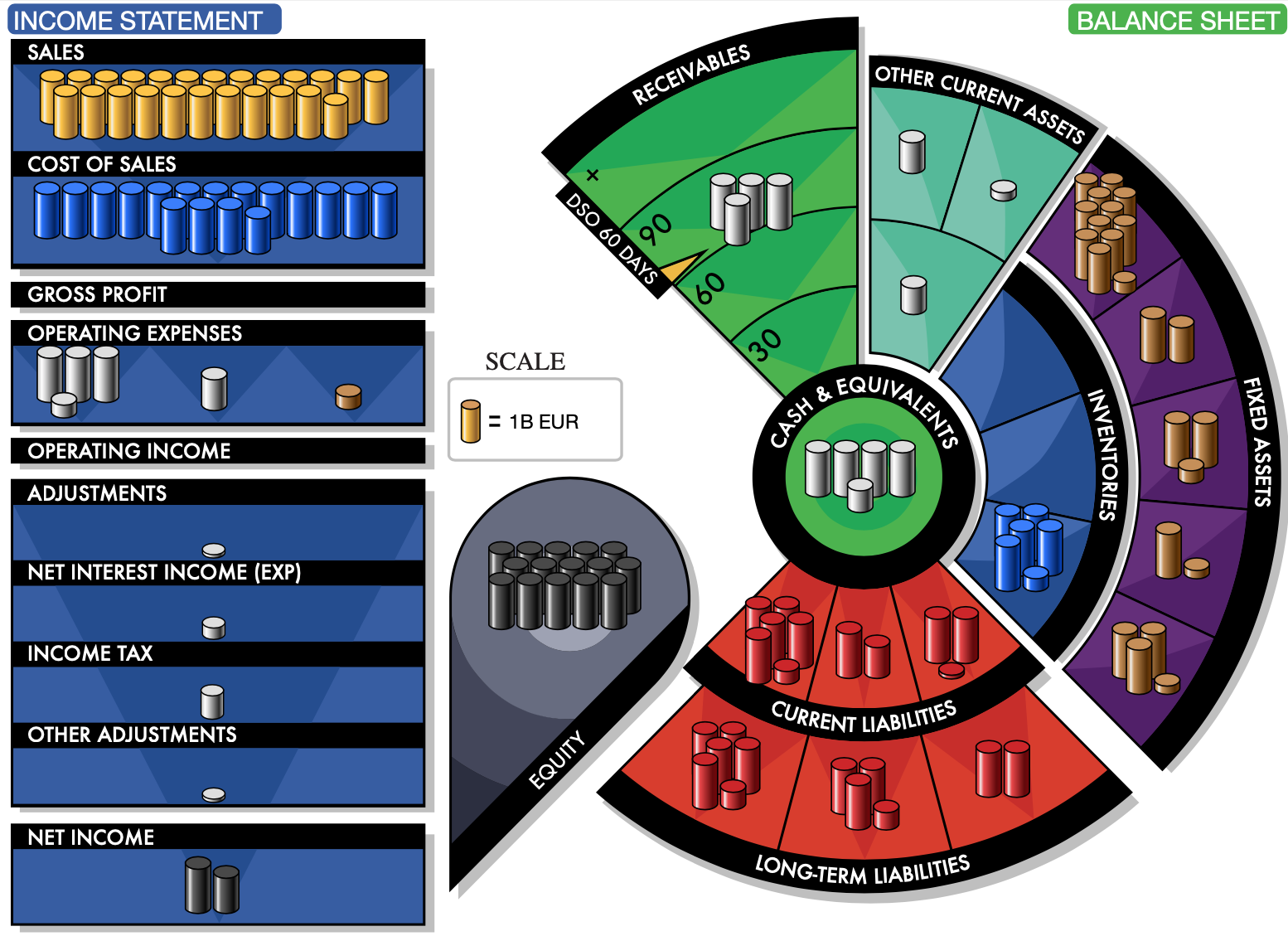

The Income Statement Equation

Sales - Expenses = Profit

The Balance Sheet Equation

Assets = Liabilities + Equity

Sales and other revenues (e.g. Investment or Adjustments):

Represented by gold stacks

Cost of Goods Sold (or Cost of Sales):

Represented by blue stacks.

Cash Expenses:

Represented by silver stacks.

Depreciation:

Represented by copper stacks.

Net Income (Profit for the period):

Represented by black stacks. (A loss is outlined in red)

Current Assets

Inventories:

Represented by blue stacks.

Cash, Receivable, and Other:

Represented by silver stacks.

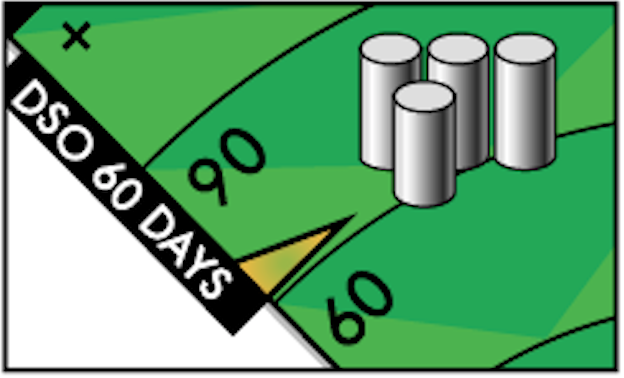

Days Sale Outstanding

is automatically calculated

Fixed Assets:

Represented by copper stacks.

Liabilities:

Represented by red stacks.

Equity:

Represented by black stacks.

(Negative equity is outlined in red)

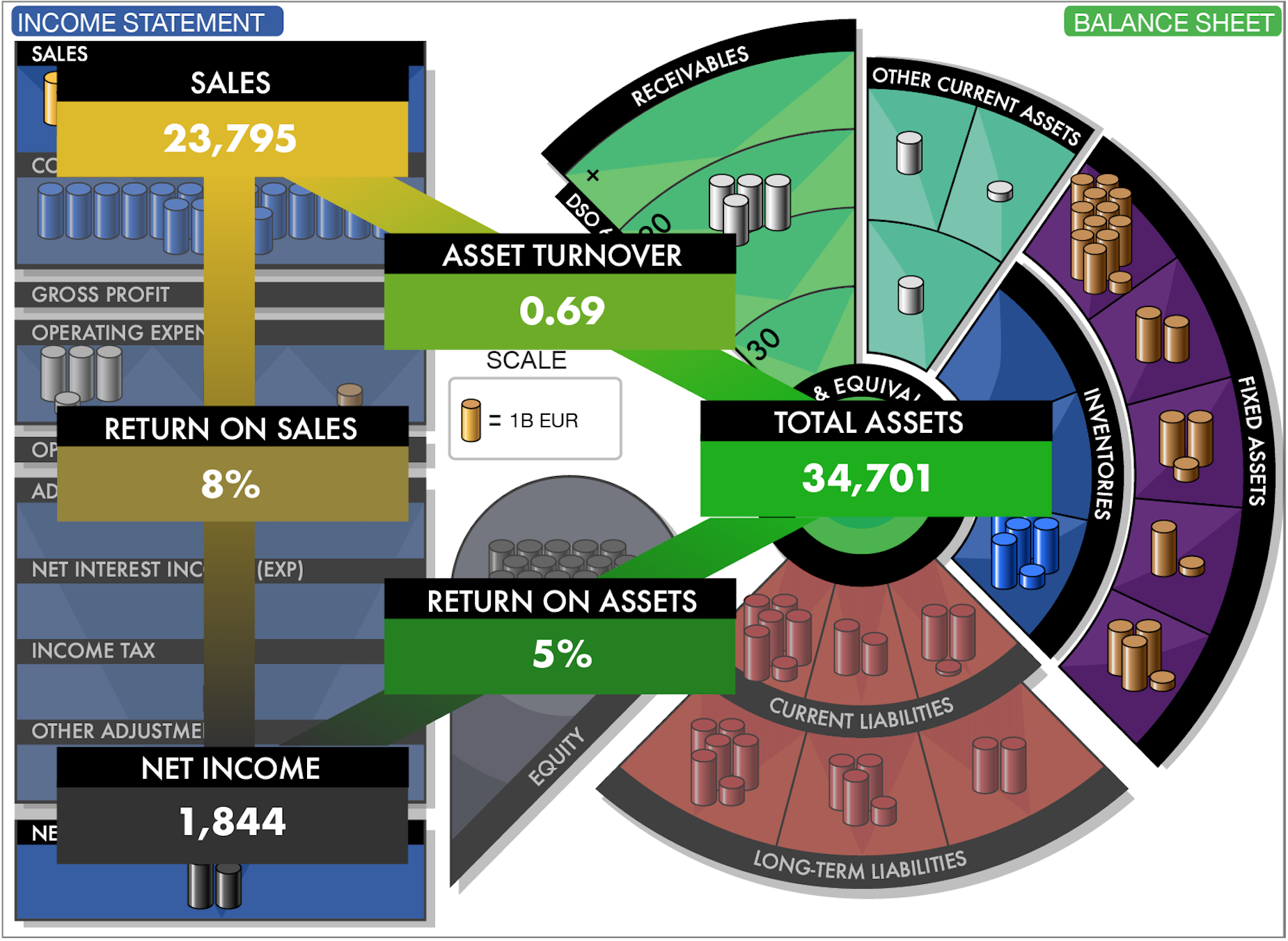

Key Ratios in Visual Finance

Return on Sales

(Profitability Ratio)

ROS shows what percentage of the sales revenue is left after you have paid costs and expenses.

ROS = Net Income/Sales x 100%

Return on Assets

ROA measures how effectively the assets are employed in the business.

ROA = Net Income/Assets x 100%

A Visual Finance look at: Michelin (France) (MGDD Y) Dec 2021

Asset Turnover

(Asset Turns)

Asset Turnover tells you how many times you ‘turned over’ your assets during the period.

ATO = Sales/Assets